Since mid-September 2024, the prices of palm oil and coconut oil have surged, causing a significant ripple effect across industries that rely on these oils for chemical derivatives. Chemicals like Sodium Lauryl Ether Sulfate (SLES), Sodium Lauryl Sulfate (SLS), Cocamide DEA (CDEA), Cocamidopropyl Betaine (CAPB), AEO-7, and AEO-9 have seen substantial price hikes, impacting industries such as personal care, cleaning products, and even food processing. In this article, we’ll explore the reasons behind this price surge, its impact on various sectors, and what the future holds for businesses and consumers alike.

Key Drivers Behind the Price Surge

Declining Palm Oil and Coconut Oil Production

Palm oil and coconut oil are primarily produced in tropical regions like Malaysia and Indonesia. These countries account for about 85% of global palm oil supply. However, production has been declining due to several factors:

- Aging Palm Trees: Many palm plantations are aging, leading to reduced yields. Replanting efforts have been slow, further exacerbating the supply shortage. The long gestation period for new palm trees to reach full production capacity means that even with replanting, supply constraints will persist in the short term.[1]

- Climate Change: Unpredictable weather patterns have severely impacted crop yields. Extended dry spells in some regions and heavy rainfall in others have disrupted harvesting operations. For example, Malaysia has experienced both droughts and flooding in key palm-growing areas, reducing output significantly. Additionally, rising temperatures have led to increased pest infestations, further hampering production.[2]

- Sustainability Measures: Stricter regulations aimed at promoting sustainable palm oil production have increased costs for producers. While these measures are essential for long-term environmental sustainability, they have contributed to short-term supply constraints. The need for producers to comply with sustainability certifications has also led to higher operational costs, which are ultimately reflected in market prices.[3]

Increased Global Demand

The demand for palm oil and coconut oil has been steadily rising across various industries:

- Food Industry: Palm oil is a staple in processed foods due to its versatility and stability at high temperatures. It is used in everything from margarine to baked goods. The growing global population and increased consumption of processed foods have driven demand for palm oil to new heights.

- Personal Care Products: Coconut oil derivatives are widely used in shampoos, lotions, soaps, and other personal care products due to their moisturizing properties. Consumers’ increasing preference for natural and organic products has also boosted the demand for coconut oil-based ingredients.

- Biofuels: Countries like Indonesia have implemented mandates requiring higher biodiesel content in fuels, which has increased the demand for palm oil as a biofuel feedstock. Governments worldwide are pushing for greener energy solutions, and biofuels made from palm oil have become a popular alternative, further straining the supply-demand balance.

As demand continues to outpace supply, prices for both oils have skyrocketed. The combined effect of constrained supply and soaring demand has created a perfect storm, resulting in significant price volatility.

The Impact on Chemical Derivatives

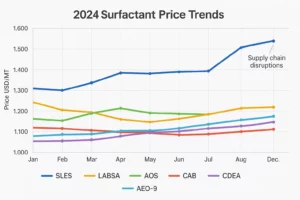

Price Increases for SLES, SLS, CDEA, CAPB, AEO-7, AEO-9

Chemicals derived from palm oil and coconut oil are essential ingredients in many everyday products:

- Sodium Lauryl Ether Sulfate (SLES): Used primarily in detergents and personal care products like shampoos due to its excellent foaming properties. Rising raw material costs have led to price increases for SLES, which is already affecting the cost structure of personal care product manufacturers.

- Sodium Lauryl Sulfate (SLS): Another key surfactant used in cleaning products, SLS prices have also risen due to the increased cost of fatty alcohols derived from palm oil.

- Cocamide DEA (CDEA) and Cocamidopropyl Betaine (CAPB): Commonly found in liquid soaps and shampoos as foam boosters and stabilizers. The rising cost of coconut oil has made these ingredients more expensive, impacting product formulations.

The rising cost of raw materials has directly impacted the production costs of these chemicals. For example, SLES and SLS prices have increased significantly due to the higher cost of palm-derived fatty alcohols used in its production. Similarly, CDEA and CAPB prices have risen as coconut oil becomes more expensive. Manufacturers are struggling to maintain profit margins as the cost of key inputs continues to rise, leading to a cascade of cost adjustments throughout the supply chain.

Supply Chain Disruptions

The rising costs of palm oil derivatives are not just limited to raw material prices. The entire supply chain has been affected:

- Shipping Costs: Fluctuations in global freight rates have added another layer of complexity. As shipping costs rise, so do the overall costs of importing raw materials from producing countries like Malaysia and Indonesia. Delays at ports, container shortages, and higher fuel prices have all contributed to increased logistics costs, adding to the challenges faced by manufacturers.

- Certification Costs: Companies that source certified sustainable palm oil (CSPO) face additional administrative and logistical burdens. The infrastructure required to keep certified products separate from non-certified ones is costly. This has created a significant cost burden for companies that are committed to sustainability, further complicating the already strained supply chain.

These disruptions have led to delays in product availability and higher costs for manufacturers. Some companies have had to reduce production rates or delay new product launches due to the unpredictability of raw material supplies.

Broader Industry Impacts

Personal Care and Cosmetics Industry

The personal care industry is one of the largest consumers of palm oil derivatives like SLES and CAPB. These chemicals are critical for formulating shampoos, body washes, lotions, and other skincare products.

As input costs rise:

- Product Pricing: Manufacturers may be forced to pass these costs onto consumers by increasing product prices. This could make personal care products less affordable, especially in price-sensitive markets. Smaller brands may face challenges in maintaining their competitive edge against larger players that can absorb cost increases more effectively.

- Formulation Changes: Some companies might explore alternative ingredients or reduce the concentration of costly ingredients like SLES or CDEA to maintain profitability without raising prices too much. The search for alternative surfactants that provide similar performance characteristics is underway, but finding cost-effective substitutes remains challenging.

Household Cleaning Products

Surfactants like SLES and SLS are crucial components of household cleaning products such as dishwashing liquids and laundry detergents. The rising cost of these surfactants could lead to:

- Higher Consumer Prices: As manufacturers grapple with increased production costs, consumers may see price hikes on everyday cleaning products. The cost of maintaining clean homes could rise, affecting household budgets globally.

- Potential Shifts Toward Alternatives: Companies may start exploring alternative surfactants that are less reliant on palm or coconut oils. Some manufacturers are considering petro-based surfactants or blends that can provide similar cleaning performance at a lower cost. Replacing SLES with LABSA partially in detergents is a common practice when SLES price increases significantly.

Food Industry

Palm oil is a common ingredient in processed foods due to its stability at high temperatures. However:

- Rising Input Costs: Food manufacturers that rely on palm oil as a key ingredient are facing higher input costs. This impacts products like margarine, snacks, and baked goods, where palm oil is a significant component.

- Price Increases for Consumers: These higher costs could ultimately be passed on to consumers through price increases on food products that contain palm oil. The cost of packaged foods is expected to rise, contributing to overall food inflation.

Biofuels Sector

The biofuels industry has seen increased demand for palm oil as countries push toward renewable energy sources:

- Increased Competition for Palm Oil: As more palm oil is diverted toward biofuel production, less is available for other industries like food processing or cosmetics. This competition for resources has driven prices even higher, putting further pressure on non-biofuel industries.

- Changing Economics: The rising cost of palm oil could make biofuels less economically viable compared to other renewable energy sources. Governments and industries may need to reconsider the balance between biofuel production and the availability of palm oil for other uses.

Future Outlook: What to Expect in the Coming Months

Continued Price Increases

Experts predict that prices for palm oil derivatives will continue rising over the next 2–3 months due to ongoing supply constraints:

- Weather Uncertainty: Climate change will likely continue affecting crop yields in key producing regions like Malaysia and Indonesia. The unpredictability of extreme weather events will make it difficult for producers to plan and maintain consistent supply levels.

- Sustained Demand: Demand from industries such as food processing, personal care products, and biofuels shows no signs of slowing down. With limited supply and ongoing demand, price pressures are expected to persist.

Potential Mitigation Strategies

To cope with rising costs, industries may adopt several strategies:

- Diversification of Raw Material Sources:

- Companies might explore alternative oils such as soybean or sunflower oils as substitutes for palm or coconut oils where feasible. This could help reduce dependence on palm oil and mitigate the impact of price increases.

- Additionally, manufacturers may look to source materials from regions less affected by climate change, thereby reducing the risks associated with regional supply disruptions.

- Sustainability Initiatives:

- Investing in sustainable practices could help stabilize long-term supply chains while addressing environmental concerns. Companies that invest in reforestation and improved agricultural practices may benefit from a more secure raw material supply in the future.

- Some companies may focus on sourcing certified sustainable palm oil (CSPO) despite the higher upfront costs associated with certification. Over time, the emphasis on sustainability could lead to greater consumer trust and brand loyalty, helping to offset the cost of certification.

- Technological Innovations:

- Biotechnology advancements could offer new ways to produce fatty acids more efficiently through microbial fermentation or genetic engineering. This would reduce reliance on traditional agricultural sources like palm or coconut oils and could help stabilize raw material costs in the long term.

- Research into synthetic surfactants and other substitutes is also being prioritized, with the goal of reducing reliance on agricultural inputs altogether. The development of lab-grown oils and fats could provide a viable alternative if production can be scaled cost-effectively.

Conclusion

The rapid increase in palm oil and coconut oil prices since mid-September 2024 has had far-reaching consequences across multiple industries. From personal care products to biofuels, the rising cost of these oils—and their chemical derivatives—has impacted manufacturers globally. The interconnected nature of global supply chains means that the effects of price increases are being felt across different sectors, leading to increased consumer prices and changing product formulations.

While some industries may pass these costs onto consumers through higher product prices, others will need to innovate or diversify their raw material sources to remain competitive. As climate change continues to disrupt agricultural production and global demand remains strong, businesses must prepare for continued volatility in the market over the coming months.

By adopting sustainable practices and exploring alternative ingredients or technologies, companies can mitigate some of these challenges while contributing positively toward environmental goals. The need for adaptability and resilience has never been greater, and the actions taken now will determine the long-term sustainability and success of industries that rely on palm and coconut oil derivatives.

Citations:

- https://dialogue.earth/en/business/palm-oil-derivatives-are-sustainability-promises-lost-in-the-supply-chain/

- https://www.chemanalyst.com/NewsAndDeals/NewsDetails/palm-kernel-oil-rush-anticipated-price-rise-ahead-in-malaysia-30338

- https://www.fortunebusinessinsights.com/fatty-acids-market-110279

- https://dialogue.earth/en/food/breaking-down-palm-oil/